Do you have money that is sitting there doing nothing, losing value while inflation marches along at 2% or higher every year?

If you do, you need to check out the high-yield savings account from Western Alliance Bank.

We have a fair amount of money that we don’t invest because it is in our emergency fund, but it loses value as it sits there. Recently, several banks in our area have advertised some CDs (certificates of deposit) with no penalty for early withdrawals, and the interest rates of 4+% on those have been quite appealing.

We have a fair amount of money that we don’t invest because it is in our emergency fund, but it loses value as it sits there. Recently, several banks in our area have advertised some CDs (certificates of deposit) with no penalty for early withdrawals, and the interest rates of 4+% on those have been quite appealing.

But I have done a CD before, and I wanted to avoid the work involved in setting one up.

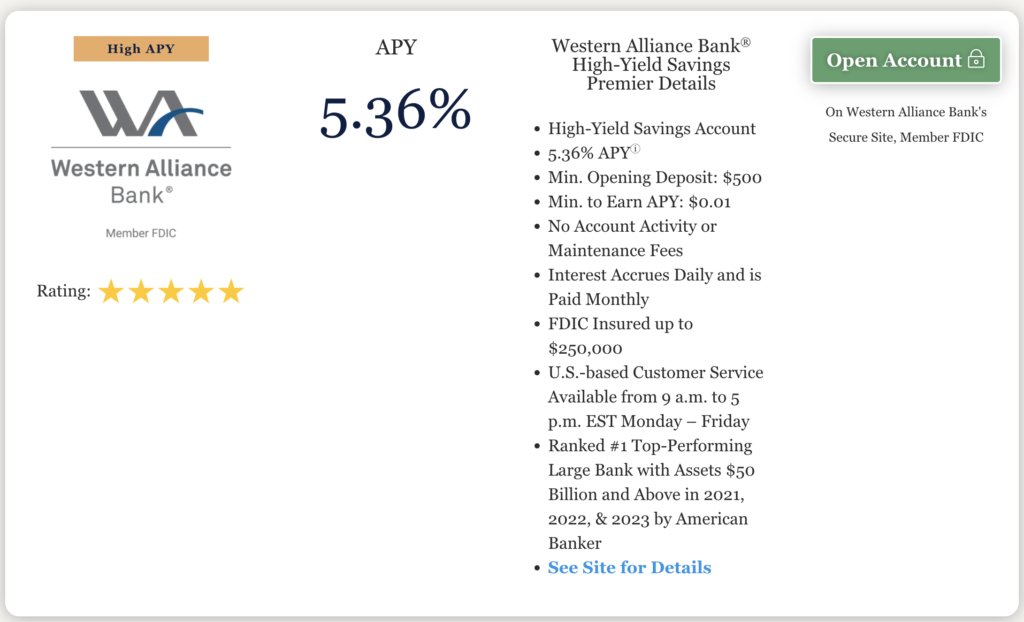

This month I was introduced to Western Alliance Bank, and I couldn’t believe the current interest rate on their high-yield savings account. 5.36% APY!

Not only that, but the amount of money to get started with them is only $500, and after that there are no account minimums and no monthly fees.

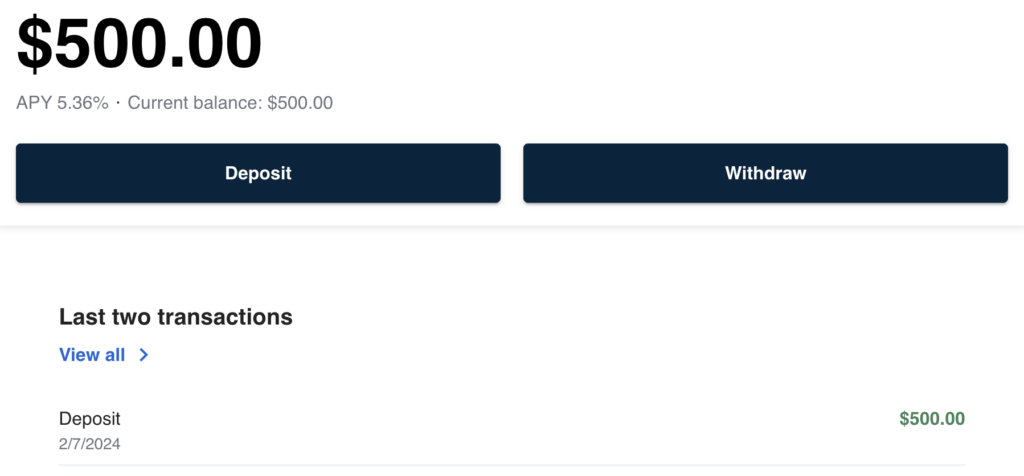

So, in my opinion, it was a no-brainer, and within 15 minutes I had created an account and funded it, and I am in the process of transferring our emergency fund over to this account.

Western Alliance’s High-Yield Savings Account

Western Alliance’s High-Yield Savings Account

Here are the reasons that I’m really happy with our new bank account:

- Competitive Interest Rates: The interest rate on its high-yield savings account is one of the highest in the US, allowing us to earn more on our savings compared to traditional savings accounts. I also have a high-yield savings account with American Express, but that one is only 4.35% APY, so I will be parking my money at Western Alliance for now.

- No Monthly Fees: Many high-yield savings accounts (and several traditional savings/checking accounts) charge monthly maintenance fees or require customers to maintain a minimum balance to avoid fees. Western Alliance Bank’s high-yield savings account has no monthly fees. Amazing.

- Low Minimum Balance Requirement: Some high-yield savings accounts require a substantial minimum balance to open or maintain the account. Western Alliance Bank’s account right now only requires an opening deposit of $500, and the lowest amount you can keep in the account and still earn interest is $0.01 (not sure how you earn interested on a penny, but that’s what they say).

- FDIC Insurance: Like all bank deposit accounts, Western Alliance Bank’s high-yield savings account is FDIC-insured up to the maximum allowable limit, currently $250,000. This insurance provides peace of mind to savers, knowing that deposits are protected against bank failure up to the specified limit. Our emergency fund will never have more than $250,000 in it, haha!

- Quick Transfers: One of the main concerns when accessing cash (especially for emergencies) is the amount of time that it takes to withdraw your money. In my experience so far, it only takes about 1-2 business days for the money to get from the account and into your hand. If you decide to couple it with another savings account and a debit card with Western Alliance, I’m guessing you could get it even sooner.

There are a couple more features that I have read about but have not actually used:

- Mobile Banking Features: Western Alliance Bank’s high-yield savings account comes with robust mobile banking features, allowing customers to manage their accounts conveniently from anywhere.

- Customer Service and Support: Western Alliance Bank is known for providing excellent customer service and support to its customers. Whether you have questions about your account, need assistance with online banking features, or require help with a transaction, knowledgeable and friendly representatives are available to assist you.

Summary

Overall, Western Alliance Bank’s high-yield savings account is a great option for savers looking to earn a competitive interest rate on their savings while enjoying the convenience and security of a traditional bank. Furthermore, you can do this without opening a CD!

As a side note, I also earned $60 for signing up for this account through a shopping portal, so that made it even better.

I’m not sure how long the APY will stay this high, but for right now, it was an offer that I could not ignore.

Do you currently have a plan for getting a decent return on your savings? If not, do you plan on taking advantage of this high-yield savings account?