Disclosures: This article includes links to credit cards. If you choose to apply for a credit card through our links, we may or may not receive a referral bonus. Credit cards are not suitable for everyone, however. If you have credit card debt of any kind, are irresponsible with your past or current use of credit cards, are unaware of the risks of using credit cards, or are conscientiously opposed to the use of credit cards, please do not apply for the credit cards mentioned in this article. You are 100% responsible for your own choices regarding the use of any credit cards mentioned here.

As frequent travelers, finding ways to maximize the value of our travel budget is essential for us. A few times a year, we have to stay in hotels, but hotel stays are some of the most significant expenses while traveling.

As frequent travelers, finding ways to maximize the value of our travel budget is essential for us. A few times a year, we have to stay in hotels, but hotel stays are some of the most significant expenses while traveling.

Fortunately, over the last few years, we have been able to stay in some really nice places for the cost of staying in a budget hotel.

How do we do it? By owning a credit card that we don’t even use!

The IHG® Rewards Premier Credit Card provides us immense value just by sitting and doing nothing. The card has many benefits, but the annual free hotel night offered by this card for only a $99 annual fee has become a game-changer in how we plan and enjoy our travels.

If you need a hotel night at least once a year, we believe the IHG® Rewards Premier Credit Card is a must-have for any savvy traveler who wants a comfortable (and sometimes luxurious) room at an affordable cost.

About the Anniversary Night Certificate

Here is a quick rundown of this specific credit card benefit:

$99 Annual Fee

Each year, upon renewal of the card, we receive a complimentary night at any eligible IHG® hotel worldwide. This benefit alone more than offsets the $99 annual fee because most hotels exceed this cost per night.

Flexibility and Choice

The beauty of the annual free hotel night certificate is its flexibility and choice. With thousands of IHG® properties around the globe spanning various brands such as InterContinental, Kimpton, Holiday Inn, and Crowne Plaza, we have the ability to redeem our certificate at a destination of my choice on any room that has an award rate of 40,000 points or less.

Unlocking Luxury Experiences

Unlocking Luxury Experiences

The IHG® Rewards Premier Credit Card allows us to indulge in luxury experiences that would otherwise be out of reach. From iconic city center hotels to beachfront resorts and boutique properties, the annual free hotel night certificate opens the door to unforgettable stays at some of the world’s most renowned destinations.

We have used this certificate to stay in downtown Santo Domingo in the Dominican Republic, a beachfront bungalow overlooking the Atlantic Ocean in Portugal, and a hotel in downtown Seattle. The stay in Portugal was absolutely amazing and definitely nothing that I could have paid cash for.

Maximizing Value and Savings

By taking advantage of the annual free hotel night benefit, I’m able to maximize the value of my IHG® Rewards points and stretch my travel budget further. Whether I’m traveling solo, with family, or for a special occasion, the savings from the complimentary night enhance my overall travel experience and allow me to explore new destinations with peace of mind.

Potential Complimentary Upgrade

In addition to the annual free hotel night benefit, the IHG® Rewards Premier Credit Card offers a range of other valuable perks, including IHG® Rewards Platinum Elite status. With Platinum Status we are often able to get complimentary upgrades on our free room. For example, when we stayed at a hotel during a layover in Miami last year, we were upgraded to a 2-bedroom suite at no charge! This perk is especially nice for families.

As mentioned, this credit card has an annual $99 fee, and you receive your first free hotel night certificate upon the first anniversary of holding the card. But there is usually a nice signup bonus with this credit card, so the points that you receive from that bonus can also be used for free nights at IHG® hotels during your first year.

Another unspoken benefit of this anniversary hotel night perk is that it can save you money in case of an emergency. If you’re traveling somewhere and your other lodging plan falls through, or if you need to book a last-minute trip, this hotel night can potentially save you a lot of money in those situations. We have had to do this a couple times!

Summary

For anyone who travels on a fairly regular basis, the IHG® Rewards Premier Credit Card is a game-changer. Its annual free hotel night benefit offers unmatched value for a modest $99 annual fee. The rewards for spending on the card itself are not spectacular, so we only keep the card for the annual free night certificate that it provides.

We get so much value from this card that we own two of them!

Whether you’re planning a weekend getaway or a dream vacation, this credit card can help you make the most of your travel adventures and perhaps even unlock unforgettable stays around the US or around the world.

Do you have a credit card with an annual fee that you don’t even use but you keep simply because of its benefits?

Until you get into the points and miles game as we have been for several years, booking airfare can be one of the most significant expenses when planning a trip. Once in a while we still have to book flights with cash, and we have several tools and strategies for finding great deals and making the best use of our money.

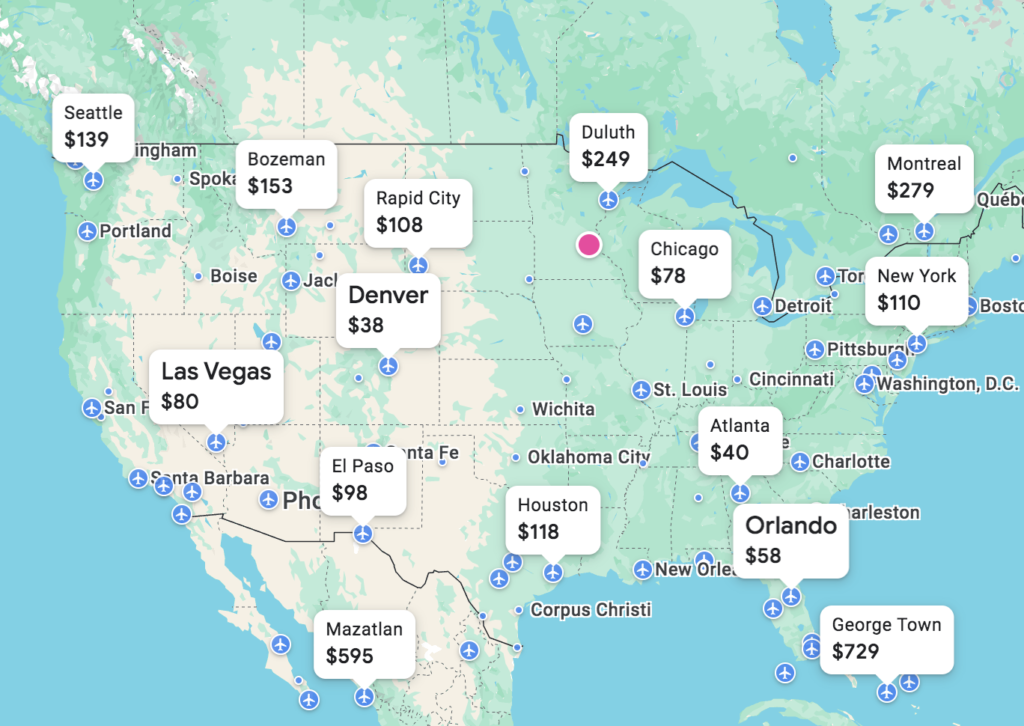

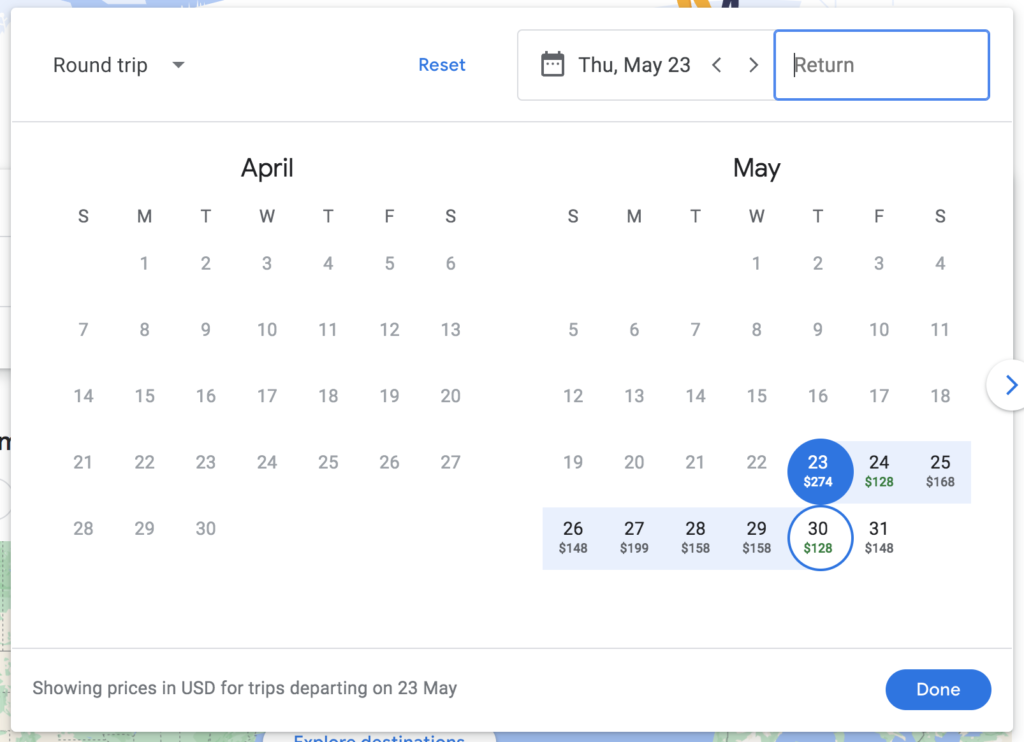

Until you get into the points and miles game as we have been for several years, booking airfare can be one of the most significant expenses when planning a trip. Once in a while we still have to book flights with cash, and we have several tools and strategies for finding great deals and making the best use of our money. Flexible Date and Destination Options

Flexible Date and Destination Options Most of our domestic travel is done with Southwest Airlines.

Most of our domestic travel is done with Southwest Airlines. We have a

We have a  We live in the Minneapolis, MN, area, have one toddler and one infant, and average about $220 or less per month between groceries and restaurants. Sadly, we even have food go bad because we cannot keep up with all the food that we have. We truly are blessed beyond measure.

We live in the Minneapolis, MN, area, have one toddler and one infant, and average about $220 or less per month between groceries and restaurants. Sadly, we even have food go bad because we cannot keep up with all the food that we have. We truly are blessed beyond measure. In 2022 when we went to Portugal, the first thing we did after leaving the airport was go to a grocery store. For less than $10 we got yogurt, drinkable yogurt, juice, crackers, cheese, and a jug of water. Paired with the breakfast that we got at our oceanside bungalow, we were set for a few days!

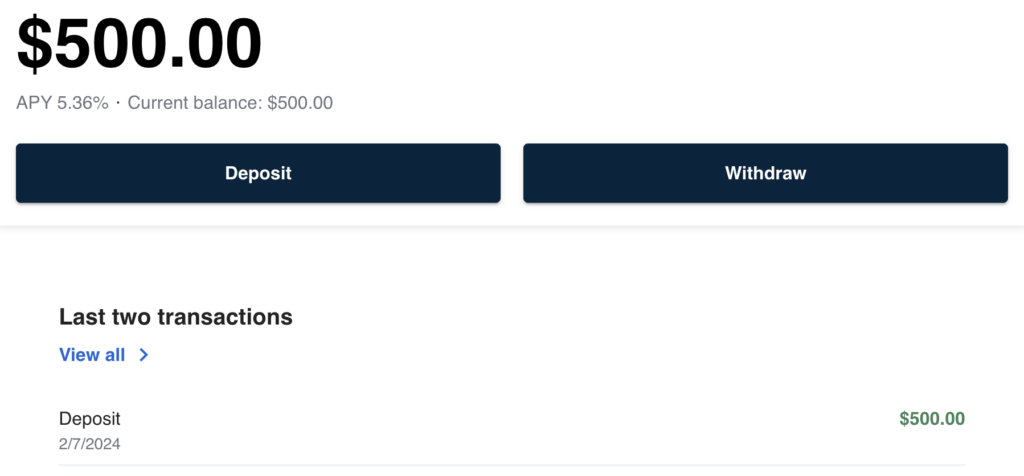

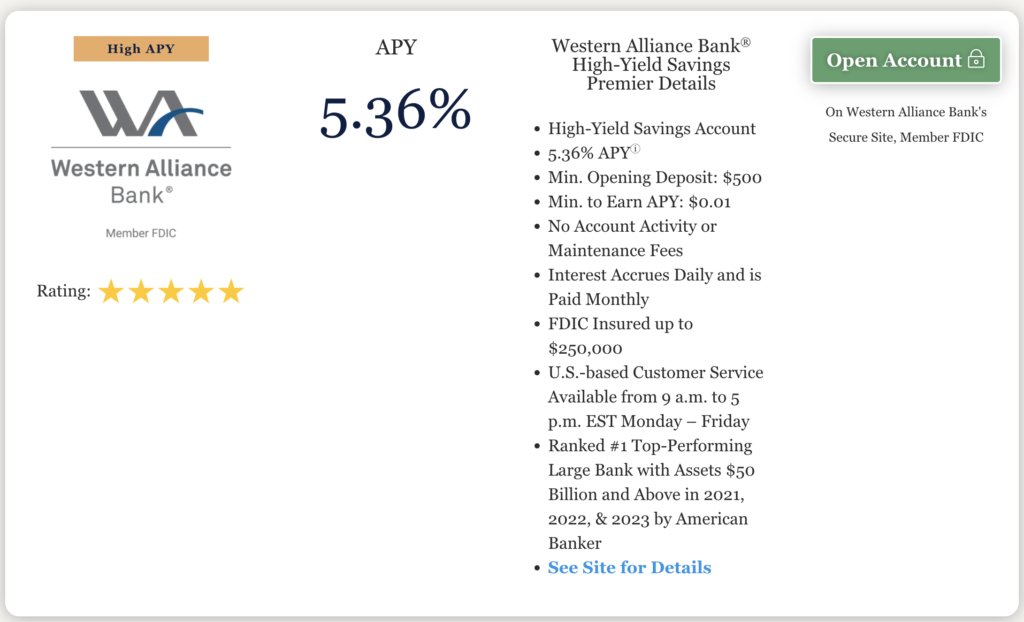

In 2022 when we went to Portugal, the first thing we did after leaving the airport was go to a grocery store. For less than $10 we got yogurt, drinkable yogurt, juice, crackers, cheese, and a jug of water. Paired with the breakfast that we got at our oceanside bungalow, we were set for a few days! We have a fair amount of money that we don’t invest because it is in our emergency fund, but it loses value as it sits there. Recently, several banks in our area have advertised some CDs (certificates of deposit) with no penalty for early withdrawals, and the interest rates of 4+% on those have been quite appealing.

We have a fair amount of money that we don’t invest because it is in our emergency fund, but it loses value as it sits there. Recently, several banks in our area have advertised some CDs (certificates of deposit) with no penalty for early withdrawals, and the interest rates of 4+% on those have been quite appealing. Western Alliance’s High-Yield Savings Account

Western Alliance’s High-Yield Savings Account

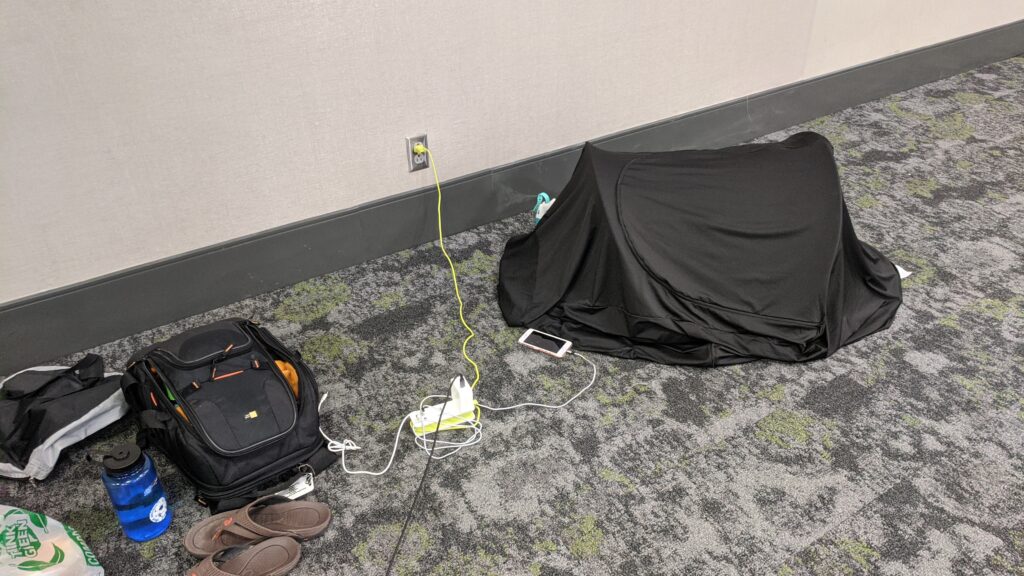

Compact and Lightweight Design: The KidCo Peapod features a compact and lightweight design, making it easy to transport and set up wherever your travels take you. It folds down into a small, portable carrying case, making it convenient to pack in a suitcase, car trunk, or carry-on bag. When we fly, one of us packs this in our carry-on roller bag so that we can use it in the airport. It’s SO small when it’s folded and stowed!

Compact and Lightweight Design: The KidCo Peapod features a compact and lightweight design, making it easy to transport and set up wherever your travels take you. It folds down into a small, portable carrying case, making it convenient to pack in a suitcase, car trunk, or carry-on bag. When we fly, one of us packs this in our carry-on roller bag so that we can use it in the airport. It’s SO small when it’s folded and stowed! Summary

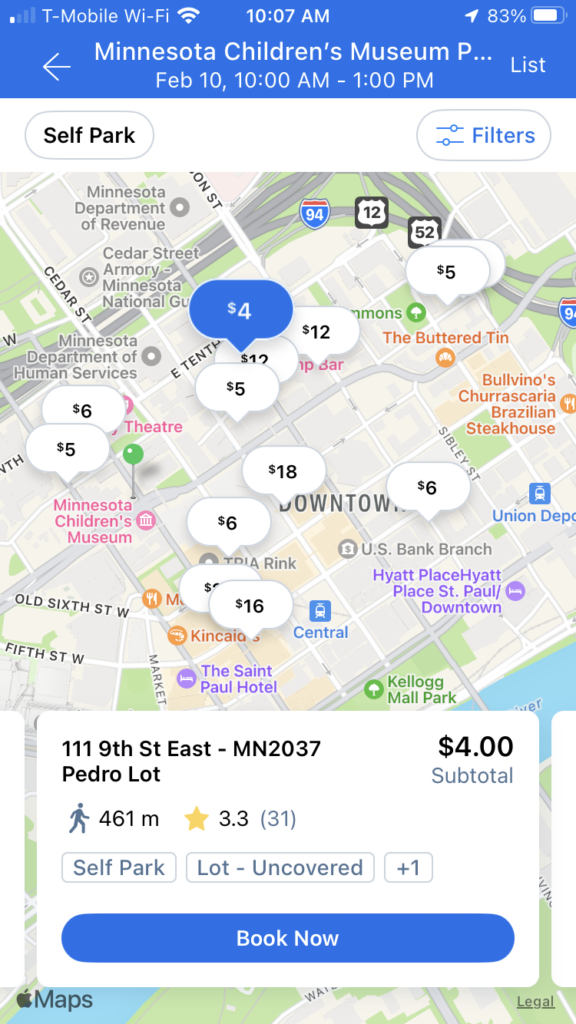

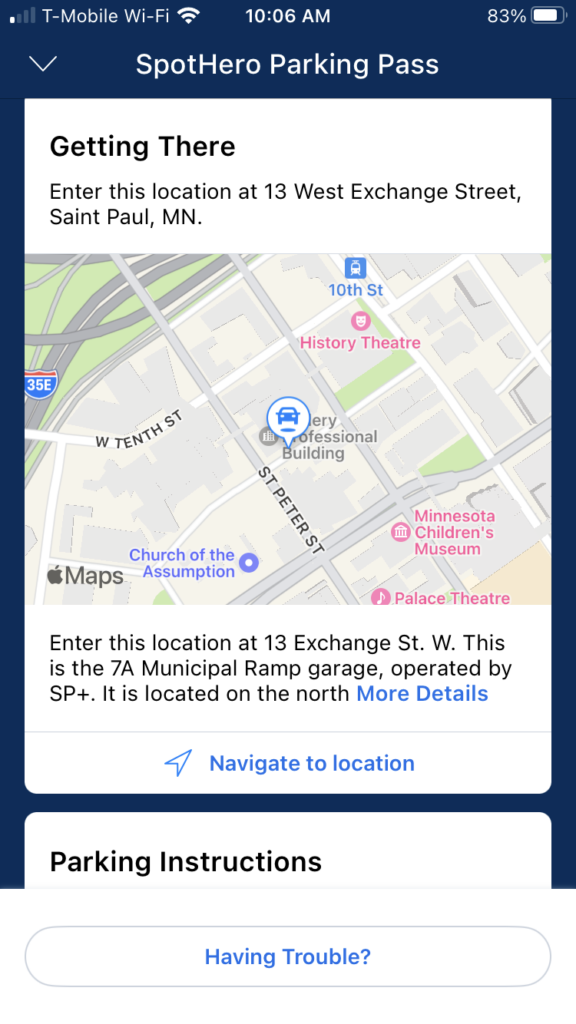

Summary We can usually park for free on the side of a street when we’re in a small town, but that’s not always the case in the big cities, especially around the big tourist sites. Sometimes special events also cause nearby parking facilities to raise their rates (or transform from free lots into paid lots).

We can usually park for free on the side of a street when we’re in a small town, but that’s not always the case in the big cities, especially around the big tourist sites. Sometimes special events also cause nearby parking facilities to raise their rates (or transform from free lots into paid lots). 3. Advanced Booking Options:

3. Advanced Booking Options:

God has blessed me with many amazing pastors- over a dozen of them. I will not list them here, but the people close to me have a good idea of who most of these men are.

God has blessed me with many amazing pastors- over a dozen of them. I will not list them here, but the people close to me have a good idea of who most of these men are. When I was a child, he spent so much time with me when we visited. He took me on his paper route, he brought me into the ditches to pick up pop cans, he taught me how to catch night crawlers, he took me fishing, he showed me his trapping route, and he took me up north to sell the skins from his trapping.

When I was a child, he spent so much time with me when we visited. He took me on his paper route, he brought me into the ditches to pick up pop cans, he taught me how to catch night crawlers, he took me fishing, he showed me his trapping route, and he took me up north to sell the skins from his trapping.

Brief Overview of the Southwest Companion Pass

Brief Overview of the Southwest Companion Pass