Disclosures: This article includes links to credit cards. If you choose to apply for a credit card through our links, we may or may not receive a referral bonus. Credit cards are not suitable for everyone, however. If you have credit card debt of any kind, are irresponsible with your past or current use of credit cards, are unaware of the risks of using credit cards, or are conscientiously opposed to the use of credit cards, please do not apply for the credit cards mentioned in this article. You are 100% responsible for your own choices regarding the use of any credit cards mentioned here.

We love to fly, and we love to get the most value possible out of our flights. Sometimes this means getting the cheapest flight possible, but not at the expense of comfort and taking our belongings with us (which is why we avoid Spirit, Frontier, and other airlines that have really cheap tickets).

One of the ways we do this is by using credit cards offered by airlines. When it comes to travel rewards and benefits, few airline credit cards compare to the Southwest consumer credit cards.

One of the ways we do this is by using credit cards offered by airlines. When it comes to travel rewards and benefits, few airline credit cards compare to the Southwest consumer credit cards.

With three distinct options tailored to different travel needs, Southwest offers some of the best credit cards for anyone looking to maximize their travel experiences. For a limited time, these cards are even better because of the incredible sign-up bonuses that are available.

Right now, each of the three Southwest consumer credit cards has an offer for 85,000 bonus points if you spend $3,000 on the card within three months of being approved. This offer is good until June 26, 2024.

With 85,000 points, you can typically book between 2-4 roundtrip award flights within the US. The taxes and fees on award flights are $5.60 per one-way flight ($11.20 for a roundtrip). This does not make award flights 100% free, but that is pretty close!

So why would you want a Southwest credit card? Let’s take a look at the three consumer cards and why we think these cards are excellent choices for travelers seeking value, flexibility, and exclusive perks.

1. Southwest Rapid Rewards® Plus Credit Card

Annual Fee: $69

Key Benefits:

- Sign-Up Bonus (until June 26, 2024): Earn 85,000 points after spending $3,000 on purchases in the first 3 months.

- 2X Points: Earn 2 points per $1 spent on Southwest purchases, Rapid Rewards hotel and car rental partner purchases.

- 1X Points: Earn 1 point per $1 spent on all other purchases.

- 3,000 Anniversary Points: Receive 3,000 points each year on your cardmember anniversary (worth approximately $42).

- No Foreign Transaction Fees: Travel abroad without worrying about extra fees.

Why It’s Great for Travel: The Southwest Rapid Rewards® Plus Credit Card offers a solid sign-up bonus and ongoing rewards that make earning points easy and straightforward. With no foreign transaction fees, this card is ideal for international travelers. The anniversary points add extra value, helping offset some of the annual fee. Good option if you book one or two roundtrip tickets on Southwest every year.

2. Southwest Rapid Rewards® Premier Credit Card

Annual Fee: $99

Key Benefits:

- Sign-Up Bonus (until June 26, 2024): Earn 85,000 points after spending $3,000 on purchases in the first 3 months.

- 6,000 Anniversary Points: Receive 6,000 points each year on your cardmember anniversary (worth approximately $84).

- 2X Points: Earn 2 points per $1 spent on Southwest purchases, Rapid Rewards hotel and car rental partner purchases.

- 1X Points: Earn 1 point per $1 spent on all other purchases.

- No Foreign Transaction Fees: Enjoy fee-free spending abroad.

- Tier Qualifying Points: Earn 1,500 tier qualifying points (TQPs) for every $10,000 spent on the card, up to 15,000 TQPs annually.

Why It’s Great for Travel: The Southwest Rapid Rewards® Premier Credit Card provides more anniversary points than the Plus version, helping offset most of the annual fee. The ability to earn tier qualifying points makes this card an excellent choice for frequent flyers looking to achieve A-List status with Southwest. This is another good option if you book one or two roundtrip tickets on Southwest every year.

3. Southwest Rapid Rewards® Priority Credit Card

Annual Fee: $149

Key Benefits:

- Sign-Up Bonus (until June 26, 2024): Earn 85,000 points after spending $3,000 on purchases in the first 3 months.

- 7,500 Anniversary Points: Receive 7,500 points each year on your cardmember anniversary (worth approximately $105).

- 2X Points: Earn 2 points per $1 spent on Southwest purchases, Rapid Rewards hotel and car rental partner purchases.

- 1X Points: Earn 1 point per $1 spent on all other purchases.

- $75 Southwest Travel Credit: Get an annual $75 credit for Southwest travel purchases.

- Four Upgraded Boardings: Enjoy four upgraded boardings per year, when available.

- 20% Back on In-Flight Purchases: Get 20% back on in-flight drinks, Wi-Fi, messaging, and movies.

Why It’s Great for Travel: The Southwest Rapid Rewards® Priority Credit Card offers the most comprehensive set of benefits among the three cards. The anniversary points, travel credit, and upgraded boarding passes provide significant value for frequent travelers and more than offset the annual fee. This is a great option if you fly with Southwest at least twice a year. Both of us have this card because we fly Southwest so often.

Why Southwest Credit Cards Stand Out for Travel

1. Companion Pass Eligibility: All three Southwest credit cards offer points that count toward earning the coveted Southwest Companion Pass, which allows you to choose one person to fly with you for free (excluding taxes and fees) every time you purchase or redeem points for a flight.

If you can get one of Southwest’s business cards and get the signup bonus this year in addition to the 85,000-point offer on one of these consumer cards, you will automatically qualify for the Companion Pass. You can read more about the Companion Pass in this article: The One Travel Deal That Has Saved Us Thousands of Dollars

2. Generous Rewards and Sign-Up Bonuses: As already mentioned, the sign-up bonuses alone can cover multiple flights, providing immediate value.

3. Flexible Redemption Options: Southwest points can be redeemed for flights with no blackout dates, giving you the flexibility to travel when it suits you best. Furthermore, Southwest points never expire, so you don’t have to worry about losing them.

4. No Foreign Transaction Fees: All three cards allow for fee-free spending abroad, making them ideal for international travelers.

5. Annual Benefits: The anniversary points, travel credits, and upgraded boardings provide ongoing value that can easily offset the annual fees.

If you have ever had a Southwest card before, one thing you should remember is that you cannot hold more than one Southwest consumer credit card at a time in your Chase account, and you cannot get a signup bonus on a card if you received a signup bonus on that same card within the last 24 months (even if you have closed the account since then).

Summary

The Southwest consumer credit cards offer a range of benefits that cater to different travel needs and preferences. Whether you choose the Plus, Premier, or Priority card, you can enjoy valuable rewards, exclusive perks, and flexibility that enhance your travel experience.

Right now with the 85,000-point signup bonus, this makes the card a no-brainer for people like us who love to fly. I wish we could take advantage of this offer, but we cannot since we both already have the Priority card. But if you are interested in flying with Southwest and normally spend about $1,000 a month already on a debit card or another credit card, this might be the perfect offer for you!

Until you get into the points and miles game as we have been for several years, booking airfare can be one of the most significant expenses when planning a trip. Once in a while we still have to book flights with cash, and we have several tools and strategies for finding great deals and making the best use of our money.

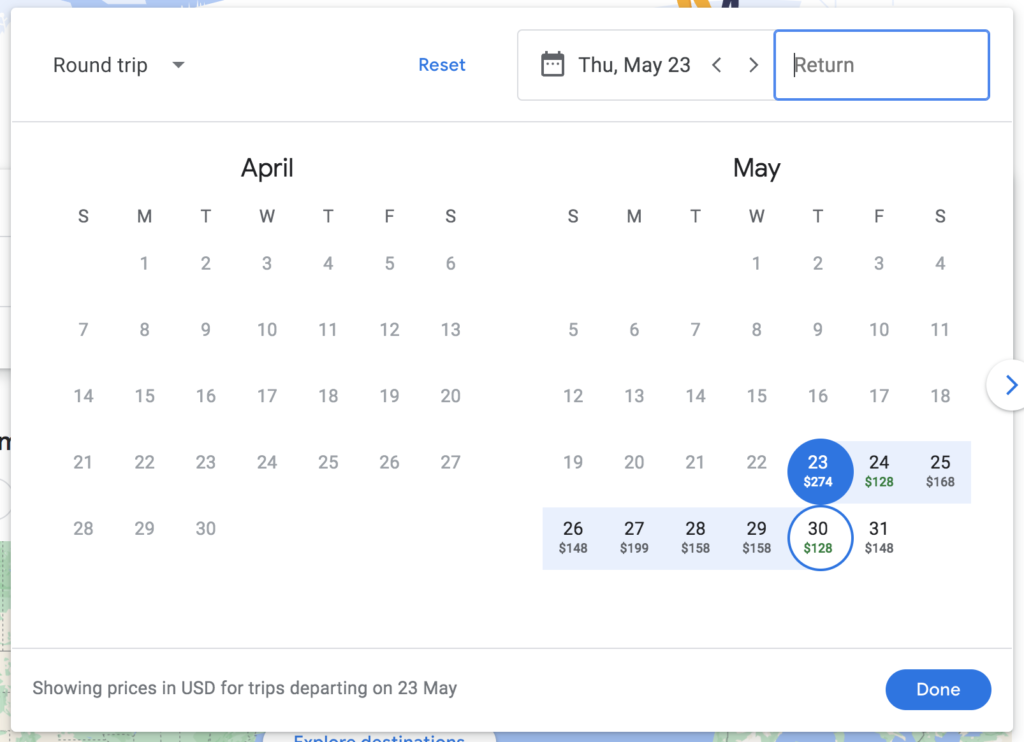

Until you get into the points and miles game as we have been for several years, booking airfare can be one of the most significant expenses when planning a trip. Once in a while we still have to book flights with cash, and we have several tools and strategies for finding great deals and making the best use of our money. Flexible Date and Destination Options

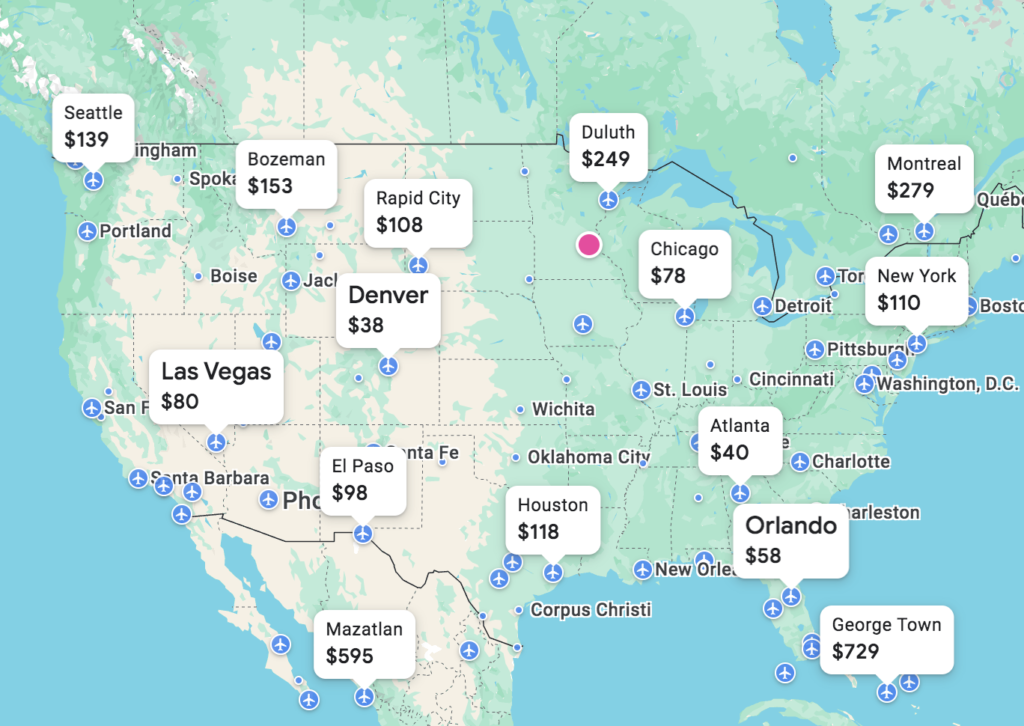

Flexible Date and Destination Options We live in the Minneapolis, MN, area, have one toddler and one infant, and average about $220 or less per month between groceries and restaurants. Sadly, we even have food go bad because we cannot keep up with all the food that we have. We truly are blessed beyond measure.

We live in the Minneapolis, MN, area, have one toddler and one infant, and average about $220 or less per month between groceries and restaurants. Sadly, we even have food go bad because we cannot keep up with all the food that we have. We truly are blessed beyond measure. In 2022 when we went to Portugal, the first thing we did after leaving the airport was go to a grocery store. For less than $10 we got yogurt, drinkable yogurt, juice, crackers, cheese, and a jug of water. Paired with the breakfast that we got at our oceanside bungalow, we were set for a few days!

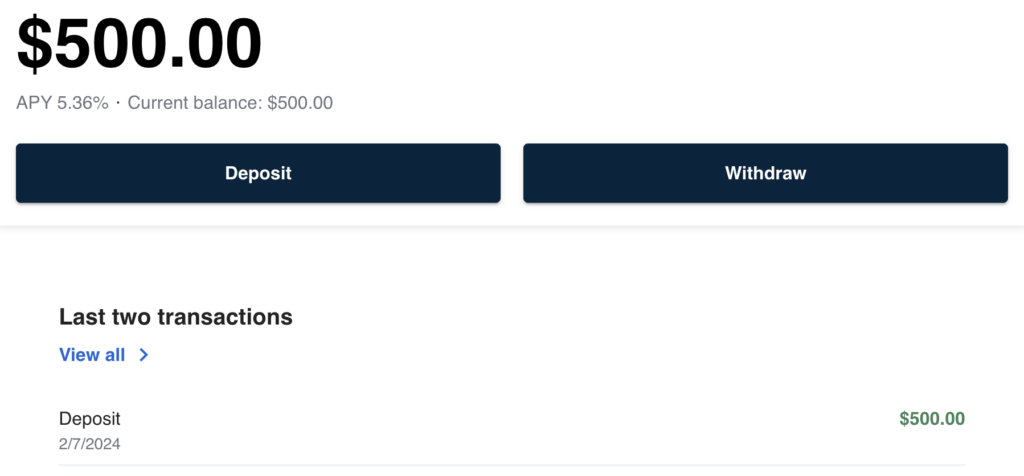

In 2022 when we went to Portugal, the first thing we did after leaving the airport was go to a grocery store. For less than $10 we got yogurt, drinkable yogurt, juice, crackers, cheese, and a jug of water. Paired with the breakfast that we got at our oceanside bungalow, we were set for a few days! We have a fair amount of money that we don’t invest because it is in our emergency fund, but it loses value as it sits there. Recently, several banks in our area have advertised some CDs (certificates of deposit) with no penalty for early withdrawals, and the interest rates of 4+% on those have been quite appealing.

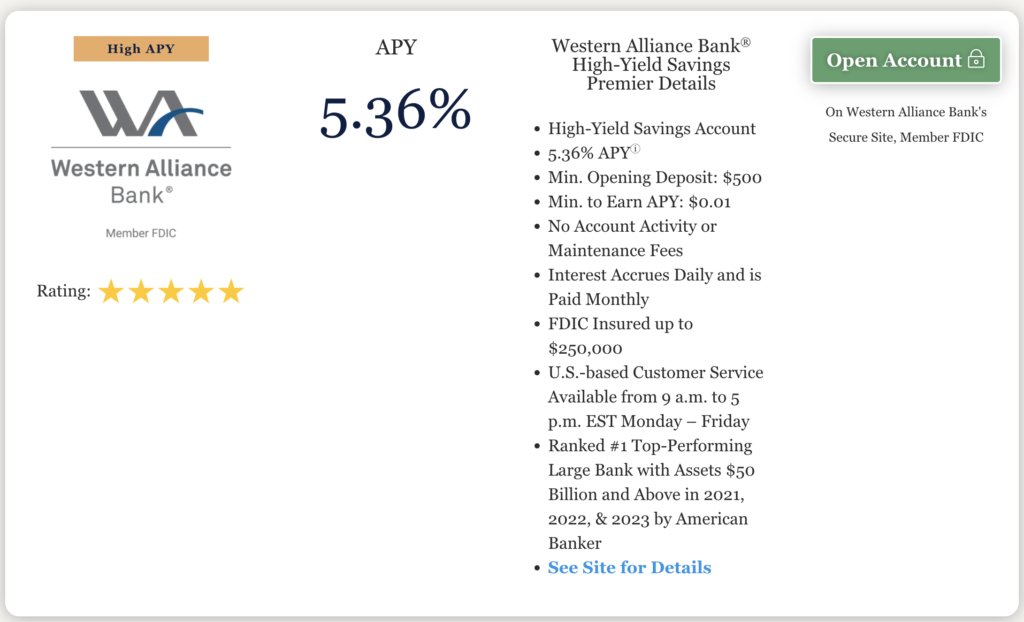

We have a fair amount of money that we don’t invest because it is in our emergency fund, but it loses value as it sits there. Recently, several banks in our area have advertised some CDs (certificates of deposit) with no penalty for early withdrawals, and the interest rates of 4+% on those have been quite appealing. Western Alliance’s High-Yield Savings Account

Western Alliance’s High-Yield Savings Account

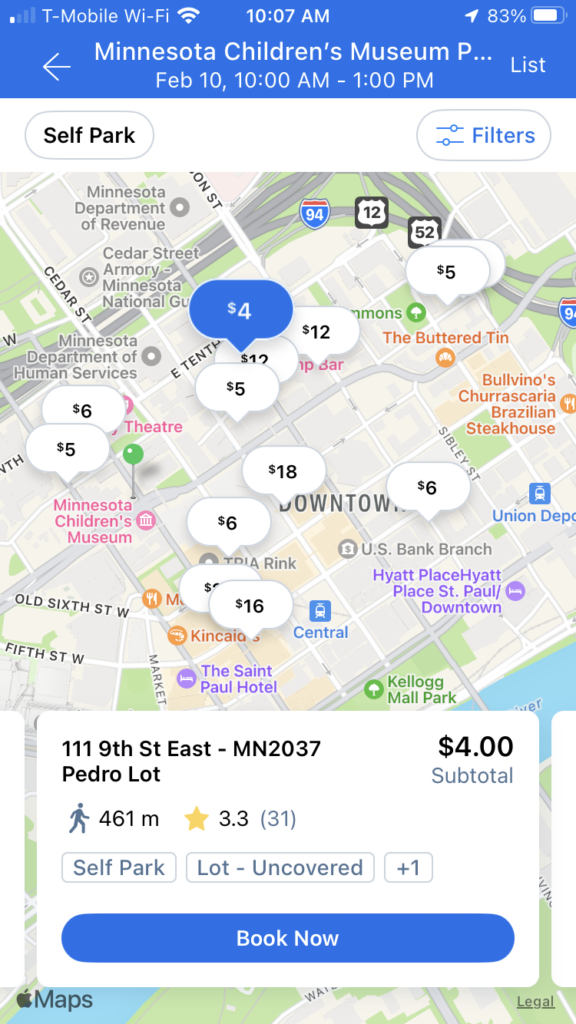

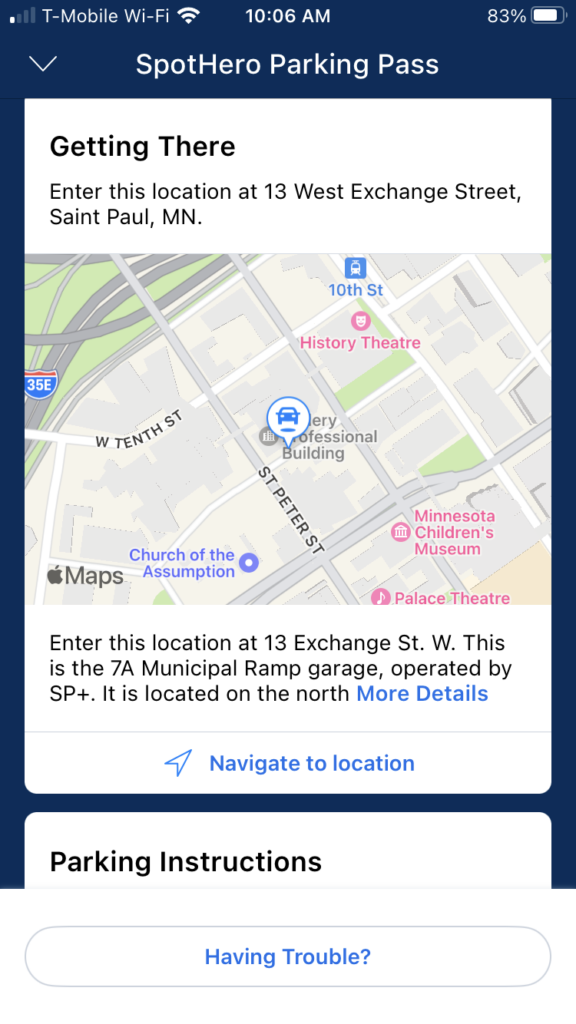

We can usually park for free on the side of a street when we’re in a small town, but that’s not always the case in the big cities, especially around the big tourist sites. Sometimes special events also cause nearby parking facilities to raise their rates (or transform from free lots into paid lots).

We can usually park for free on the side of a street when we’re in a small town, but that’s not always the case in the big cities, especially around the big tourist sites. Sometimes special events also cause nearby parking facilities to raise their rates (or transform from free lots into paid lots). 3. Advanced Booking Options:

3. Advanced Booking Options:

Brief Overview of the Southwest Companion Pass

Brief Overview of the Southwest Companion Pass

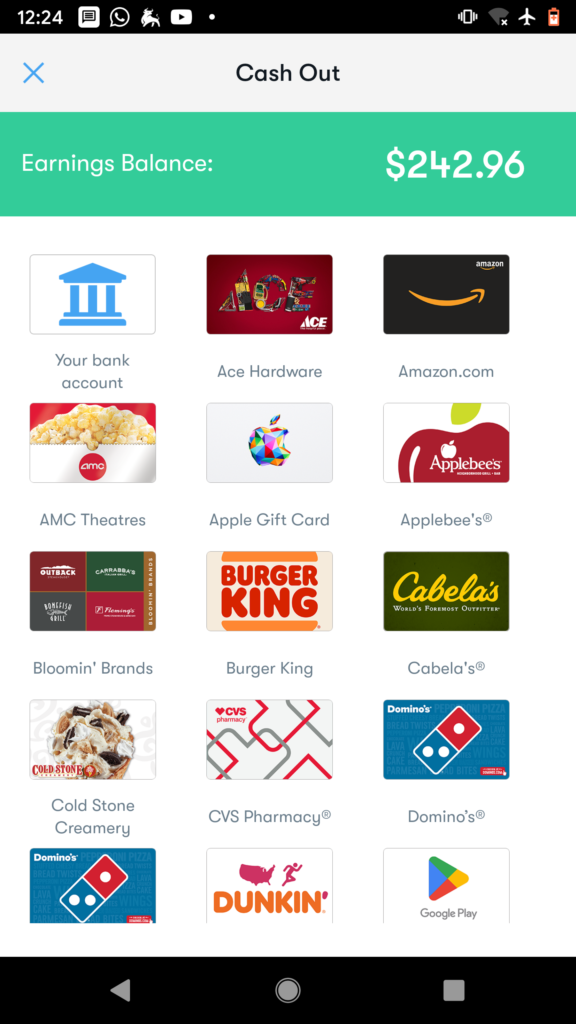

Retail Stores

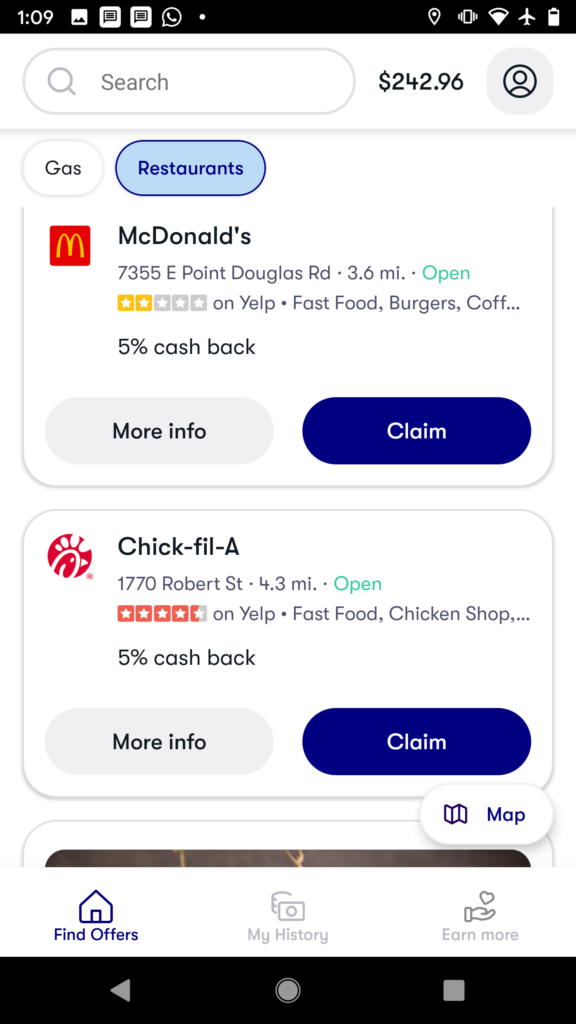

Retail Stores There are times when Upside doesn’t work or cannot be used. Hopefully this list answers any questions that you might have.

There are times when Upside doesn’t work or cannot be used. Hopefully this list answers any questions that you might have.